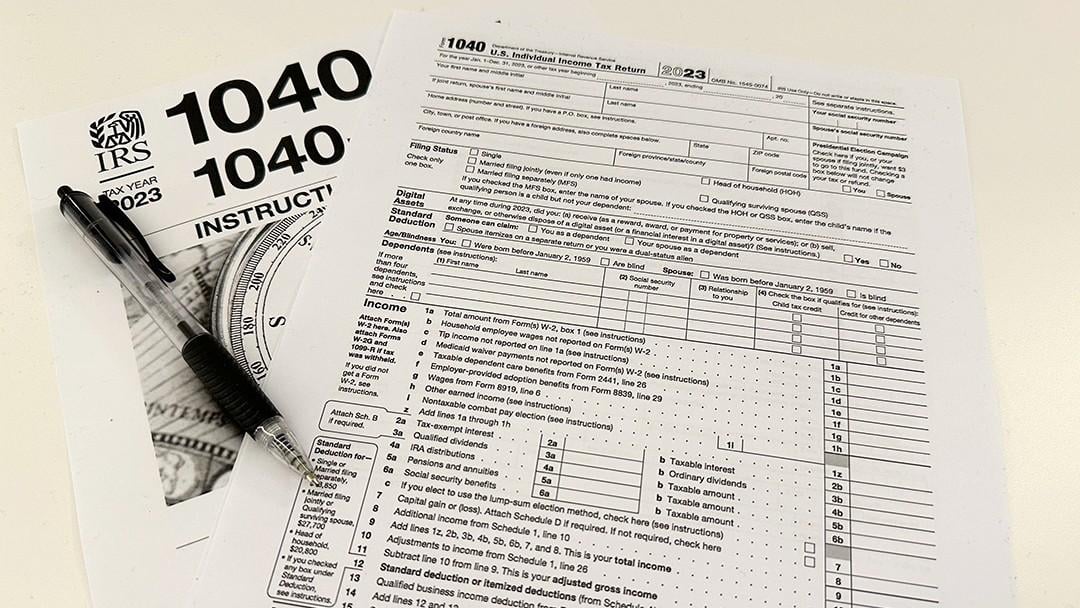

Schedule 1 2024 Instructions 1040 – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024 on the standard Form 1040. It includes sections for . These limits are noted in the table below for both the 2023 and 2024 tax years The amount from line 10 of Schedule 1 is then transferred to line 8 of Form 1040 or Form 1040-SR. .

Schedule 1 2024 Instructions 1040

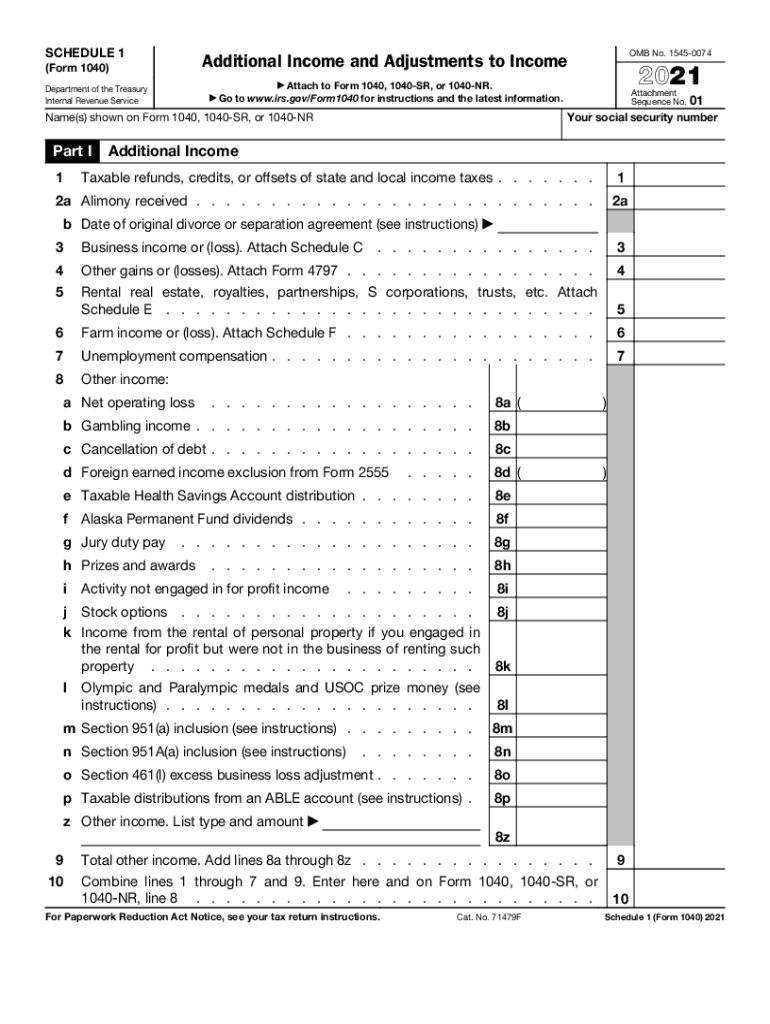

Source : www.irs.gov2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govWhat is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

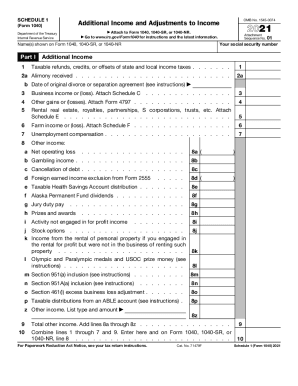

Source : turbotax.intuit.comIRS 1040 Schedule 1 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comAP | Tax season is under way so how do we navigate? | Laurinburg

Source : www.laurinburgexchange.comTax season is under way. Here are some tips to navigate it. | WNCT

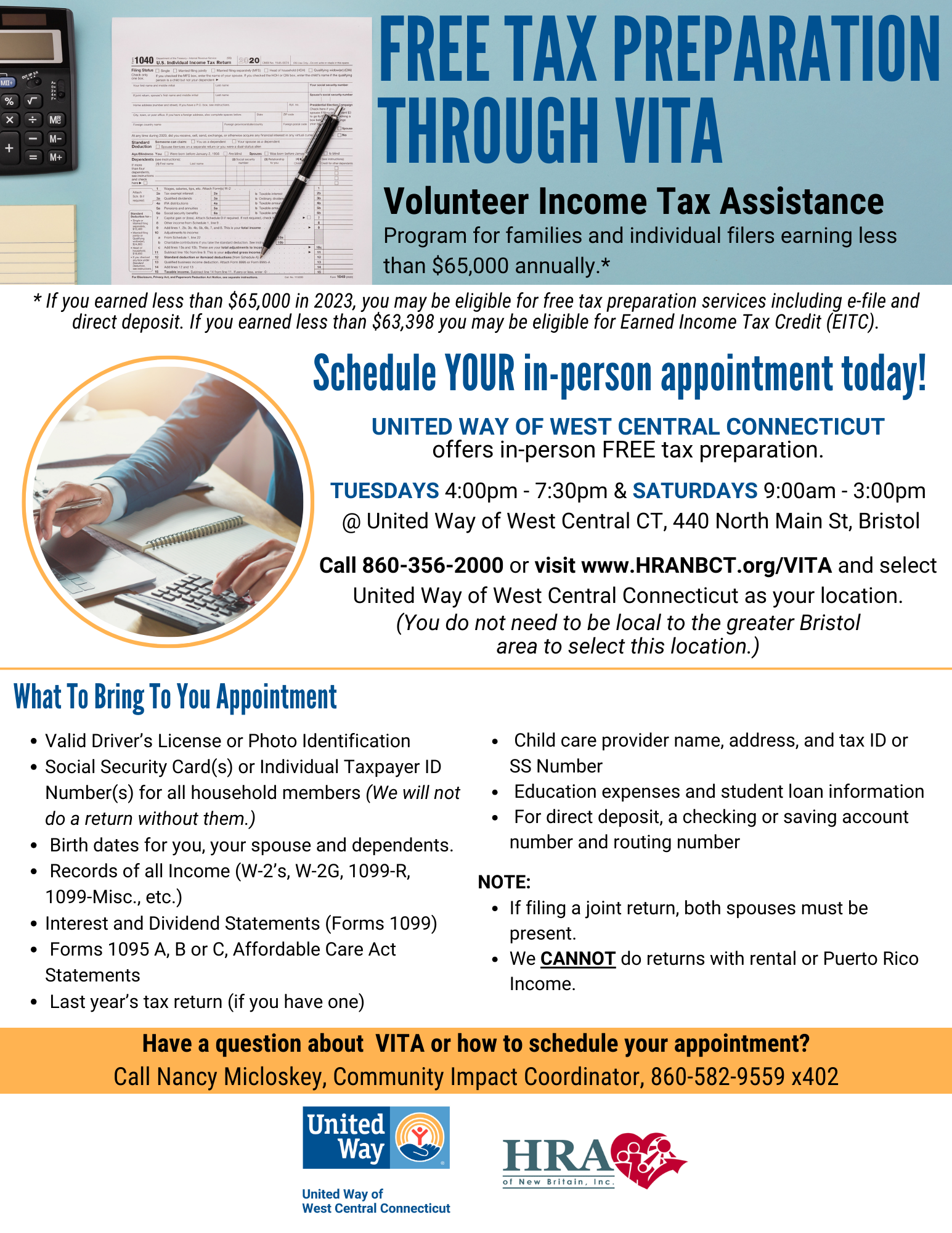

Source : www.wnct.comFree Tax Preparation Service | United Way of West Central Connecticut

Source : www.uwwestcentralct.orgAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comSchedule 1 2024 Instructions 1040 1040 (2023) | Internal Revenue Service: For 2023, the $600 threshold is delayed the companies to report payments on 1099-Ks and a $5,000 threshold is planned for 2024 a 1040 form, which is reported on line 8 of Schedule 1. . Q. My husband passed away in January 2024, two weeks away from his 73rd birthday. I am 65, disabled and receiving disability payments from Social Security. My husband had a 401(k) plan in which I was .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)